Businesses need money like people need water. Though over 80% of businesses start and grow without outside funding, just about everyone considers borrowing money at some point.

As the adage goes, “You have to spend money to make money,” and if it’s someone else’s money that you’re spending, you want it to be a win-win situation. The lender wins when you pay the money back on time and with interest, and you win by achieving growth objectives in ways where profits more than cover interest expenses. As an added bonus, society also wins when the results lead to more job opportunities along with products and services that satisfy needs!

Before you go borrowing, though, you will want to first ask what you need the money for.

What’s the money for?

The five most common reasons people seek outside funding include:

- Working Capital

- Purchasing an Asset

- Venture Launch

- Growth Funding

- Debt Restructuring

Choose one of these broad categories and then work at documenting in detail what the funds will be used for. This process will help to reveal how much money is needed and is aided by first thinking forward and then working backward.

How much money is needed?

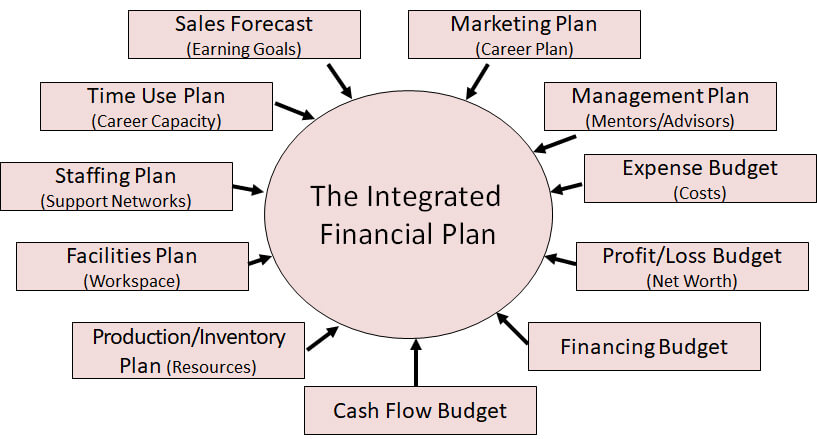

To determine how much money is needed, as well as how it will be repaid, start with your end goal and work backward to define the elements necessary for getting you there. Begin with your sales forecast while considering how much you can sell given your current capacity. This information drives your marketing plan, which then leads to what you will need in terms of staff, time, management skills, capacity (production and/or services), and facilities to achieve your sales goals. You are now ready to work the numbers to determine how much money you need to cover projected expenses, support cash flow and pay back funds with interest.

To determine how much money is needed, as well as how it will be repaid, start with your end goal and work backward to define the elements necessary for getting you there. Begin with your sales forecast while considering how much you can sell given your current capacity. This information drives your marketing plan, which then leads to what you will need in terms of staff, time, management skills, capacity (production and/or services), and facilities to achieve your sales goals. You are now ready to work the numbers to determine how much money you need to cover projected expenses, support cash flow and pay back funds with interest.

Where will your funding come from?

Historically, there are ten common funding sources most people turn to when starting and growing a business. Each one offers varying interest fees, payment terms, and pros and cons.

- Personal Funds

- Family, Friends (& Fools <grin>)

- Credit Card Debt

- Term Loans

- Low-Interest Small Loans

- Microloans

- Bank Loans

- SBA-Backed Loans

- Angel Funding

- Venture Capital

In addition, below are several alternative funding sources that offer additional flexibility in terms of costs and benefits:

- Crowd Funding

- Receivable Financing

- Merchant Services Advance

- Federal/State Investment Agencies

- Federal/State Loan/Grant Programs

- Supplier (Trade) Credit

- Business Accelerators

To evaluate what type of funding may suit your business needs, use the Financial Sources Matrix. This 1-page worksheet helps you to map funding sources to funding needs based on your stage of business and what the funds will be used for.

Don’t go it alone

Last but not least, check out America’s Small Business Champions Network to connect with over 30,000 no-cost public programs tailored to helping all of us to start, grow and succeed in business. This includes access to experienced business counselors, financial advisors, marketing help, and much more. The more you succeed, the more we all succeed.

Go forth and prosper!